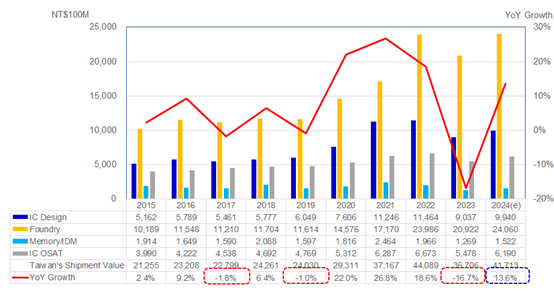

At the annual MIC Forum held on April 16, Market Intelligence & Consulting Institute (MIC) unveiled its latest findings, indicating that Taiwan's semiconductor industry is anticipated to achieve a 13.6% year-on-year growth in 2024. It is expected to reach NT$4.17 trillion (US$130.3 billion; US$1=NT$32), with the supply chain emerging from high inventory levels. Driven by advanced processes, the revenue of Taiwan's semiconductor foundries is expected to grow significantly in 2024, reaching NT$2.4 trillion (US$75 billion), up 15% year-on-year. In the memory sector, nearing supply-demand equilibrium in the fourth quarter of 2023 indicates significant growth momentum in 2024, with an anticipated 20% year-on-year growth rate. However, the IC design and IC packaging & testing segments are conservatively estimated to grow by 10% and 13%, respectively, due to uncertainties in end-demand visibility and ongoing adjustments in the supply chain.

Taiwan Semiconductor Industry Shipment Value, 2015~2024

Note: US$1=NT$32

Source: MIC, April 2024

Looking ahead to the long-term trends in the semiconductor industry, Jerry Peng, an industry consultant at MIC, remains optimistic. He highlights the profound impact of next-generation communication networking technology development, infrastructure building, and the integration of AI technology across various application domains, which are expected to revolutionize human society's lifestyle and production models. As semiconductors form the core support for these emerging technologies, the demand for semiconductor components is projected to continue rising. Additionally, the flourishing digital economy and the substantial increase in smart applications across various sectors are driving the digital transformation of the physical world. This surge is accelerating the adoption of embedded systems, industrial control, and other technologies across industries such as manufacturing, automotive, and consumer electronics, thereby boosting demand for semiconductors and driving rapid expansion in the global semiconductor market.

Focusing on global semiconductor manufacturing investment trends, MIC presents two key observations. First, global semiconductor fab capital expenditure (CapEx) saw a significant 13% decline in 2023, with a projected modest growth of 2% in 2024, reaching US$161.3 billion, as most major fabs continue to adopt austerity measures. Looking ahead to 2025, global semiconductor fab CapEx is forecasted to increase to US$182.6 billion, marking a ten-year high and representing a 13% annual growth rate. Second, in 2024, memory fabs' investment focus will be on capacity expansion at advanced process nodes such as high-bandwidth memory (HBM) and DDR5. The rapid development of HBM, driven by applications like generative AI and supercomputers, will see three major memory fabs launching the fifth generation of HBM (HBM3E) in 2024. It is anticipated that HBM shipments will account for over 50% of total HBM shipments in the fourth quarter of 2024. Additionally, the global HBM market size is expected to continue expanding. In 2023, the global HBM market size was approximately US$ 4 billion, accounting for around 8% of DRAM. It is estimated that the proportion will reach 10% to 15% in 2024

Market Intelligence & Consulting Institute (MIC) hosts the MIC Forum at Shangri-La's Far Eastern Plaza Hotel, Taipei (Taiwan) from April 16-18. For further information, please visit the Event website (available in Mandarin only).

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a major government think tank, and one of the leading IT research institutes in Taiwan. MIC specializes in industry and market research. With over three decades of experience, MIC provides valuable insights and data-driven recommendations to assist businesses in making informed decisions.

To know more about this topic, please visit: Is AI Set to Fuel Massive Semiconductor Demand!? (free download), Stay Ahead: 2023 Semiconductor Industry Research Value Pack, Industry Policies of Third-Generation Semiconductors - SiC - in Japan, Korea, and China

For future receipt of press releases, please subscribe here

To know more about MIC research findings, please access our website.

For future inquiry, please contact MIC Public Relations

If you prefer not to receive notifications, please click here to unsubscribe